What's Going On With PacWest Bancorp Stock? Markets Insider

David McNew/Getty Images New York CNN — PacWest Bancorp (PACW) is set to merge with Banc of California and raise $400 million in equity, according to a joint announcement the banks released.

PacWest Bancorp 2020 Q1 Results Earnings Call Presentation (NASDAQ

Provided by Business Wire Nov 30, 2023 9:15 PM UTC Banc of California Announces Completion of Transformational Merger with PacWest Bancorp and $400 Million Equity Raise Combined bank emerges as.

PACWEST BANCORP FORM 8K EX99.1 November 26, 2012

LOS ANGELES, November 30, 2023 -- ( BUSINESS WIRE )--Banc of California, Inc. ("Banc of California") (NYSE: BANC) today announced the completion of its transformational merger with PacWest.

PacWest (PACW) Attractive Valuation With Loan Growth Prospect

Loans and leases held for investment, net of deferred fees, increased by $949.1 million or 3.4% in the fourth quarter of 2022 to $28.6 billion at December 31, 2022.

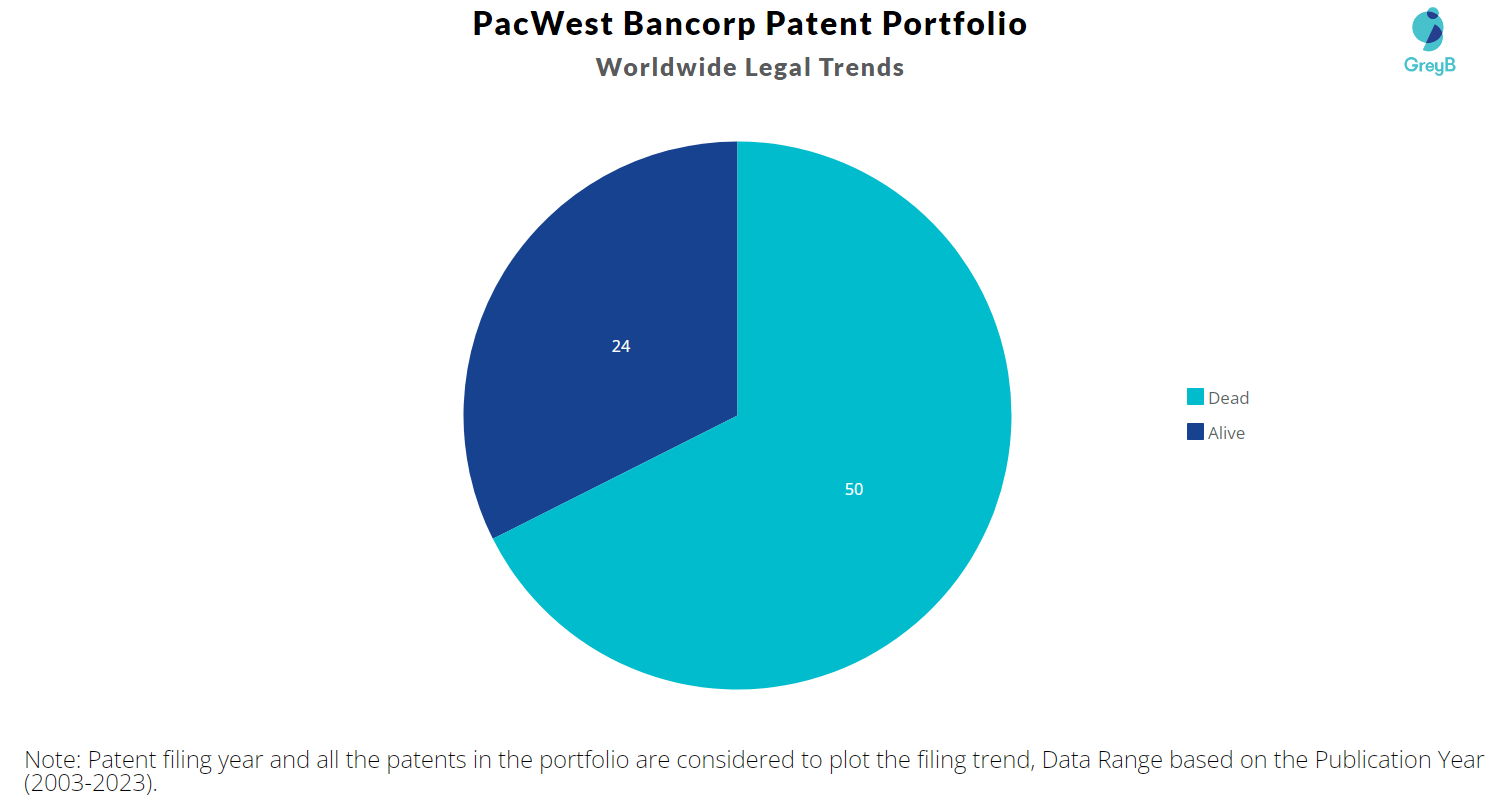

PacWest Bancorp Patents Key Insights and Stats Insights;Gate

PacWest Bancorp (PACW) NASDAQ Create Alert Add to Watchlist PacWest historical data, for real-time data please try another search 7.54 0.00 0.00% 30/11 - Closed. Currency in USD ( Disclaimer ).

PACWEST BANCORP FORM 8K EX99.1 November 30, 2009

The documents filed by Banc of California or PacWest with the SEC also may be obtained free of charge at Banc of California's or PacWest's website at https://investors.bancofcal.com, under the.

PacWest Bancorp 52 in AH, si valutano le opzioni, compresa la

PacWest Bancorp (PACW) NASDAQ 8.10 -0.01 (-0.12%) 24/11 Close USD Disclaimer After-Hours 8.11 0.00 (0.06%) 1:38:27 GMT Overview Profile Chart News & Analysis Technical Financials Community.

PacWest Bancorp Dividend Safety

Key Points. PacWest Bancorp delivered a Q2 earnings beat Tuesday afternoon, reporting a profit of $0.22 per share. More importantly, though, Banc of California is buying PacWest. The two.

PacWest Bancorp Silicon Spectra

PacWest Bancorp's merger with Banc of California is expected to benefit shareholders and provide cost optimization and synergies. The merger will create a combined bank with $36.1 billion in.

on Twitter "⚠️BREAKING *PACWEST BANCORP SHARES PLUNGE

Financial fact sheet NASDAQ: PACW l $22.60 (9.30.22) Third quarter 2022 at a glance $122.2M net earnings available to common stockholders $27.0B total average loans $34.9B total average deposits Fiscal period comparison $40.8B total average assets $4.0B total average shareholders' equity

PACWEST BANCORP FORM 8K EX99.2 July 22, 2013

PacWest Bancorp is investing in technology to enhance its digital capabilities and improve the customer experience. The company recently launched a new online banking platform, which has received positive customer feedback. Like all companies, PacWest Bancorp faces several potential risks and challenges. The company is exposed to credit.

PacWest Leads RegionalBankStock Plunge as First Republic Sale Fails

Contact Us U.S. Markets closed Banc of California, Inc. (PACW) NasdaqGS - NasdaqGS Real Time Price. Currency in USD Follow 2W 10W 9M 7.54 -0.21 (-2.71%) At close: 04:00PM EST 1d 5d 1m 6m YTD 1y 5y.

Why PacWest Bancorp Shares Are Nosediving Premarket Thursday

NASDAQ:PACW Financials PacWest Bancorp reported earnings results for the third quarter and nine months ended September 30, 2023. For the third quarter, the company reported net interest income.

Why PacWest Bancorp’s (PACW) Stock Is Up 6.05 AAII

Company Release - 11/22/2023 Merger proposal receives in excess of 98% approval of the shares voted from each of Banc of California and PacWest Bancorp stockholders

PacWest Bank Shares Plummet More Than 50 Percent After Report of

Earlier this year, Banc of California and PacWest Bancorp announced to merge. Read why at current prices, PACW, BANC, and PACWP stocks are reasonable investments.

PacWest Bancorp Heading Into An Uncertain Weekend

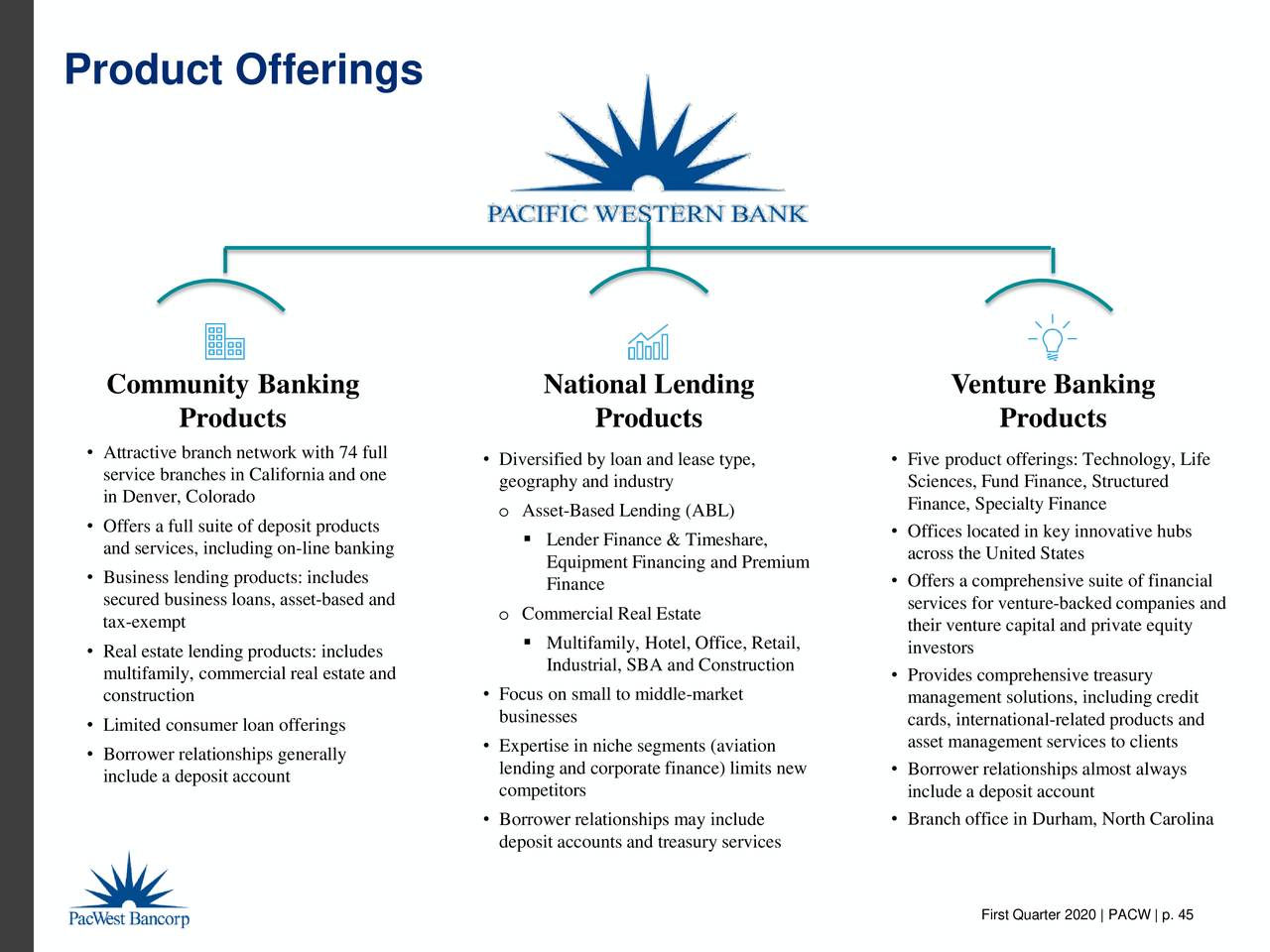

PacWest is a bank holding company headquartered in Los Angeles, California, with an executive office in Denver, Colorado, with one wholly-owned banking subsidiary, Pacific Western Bank (the "Bank").